In the two years 2023 – 2024, the civil engineering sector is expected to grow, while residential construction is facing an abrupt slowdown in the same period, according to a forecast by EUROCONSTRUCT. This residential slowdown will be most pronounced in Sweden, Italy, Finland, and Hungary. However, countries with larger residential markets like the UK, Germany, and France are also facing considerable losses. Non-residential building should stagnate during this two-year period, before experiencing a revival.

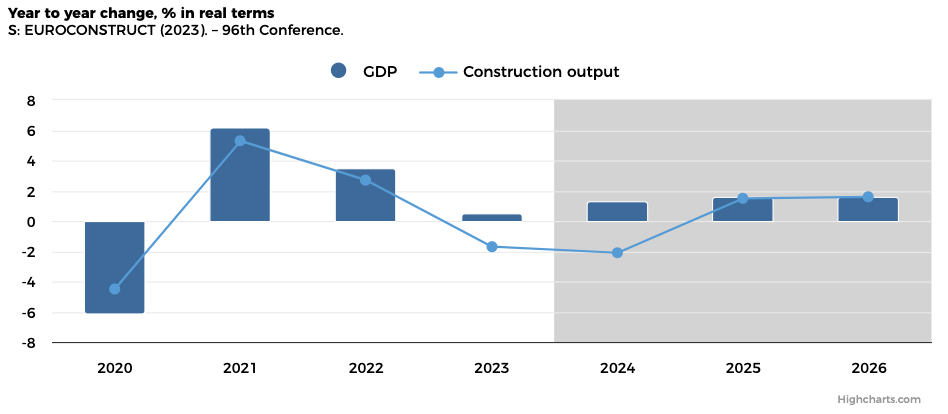

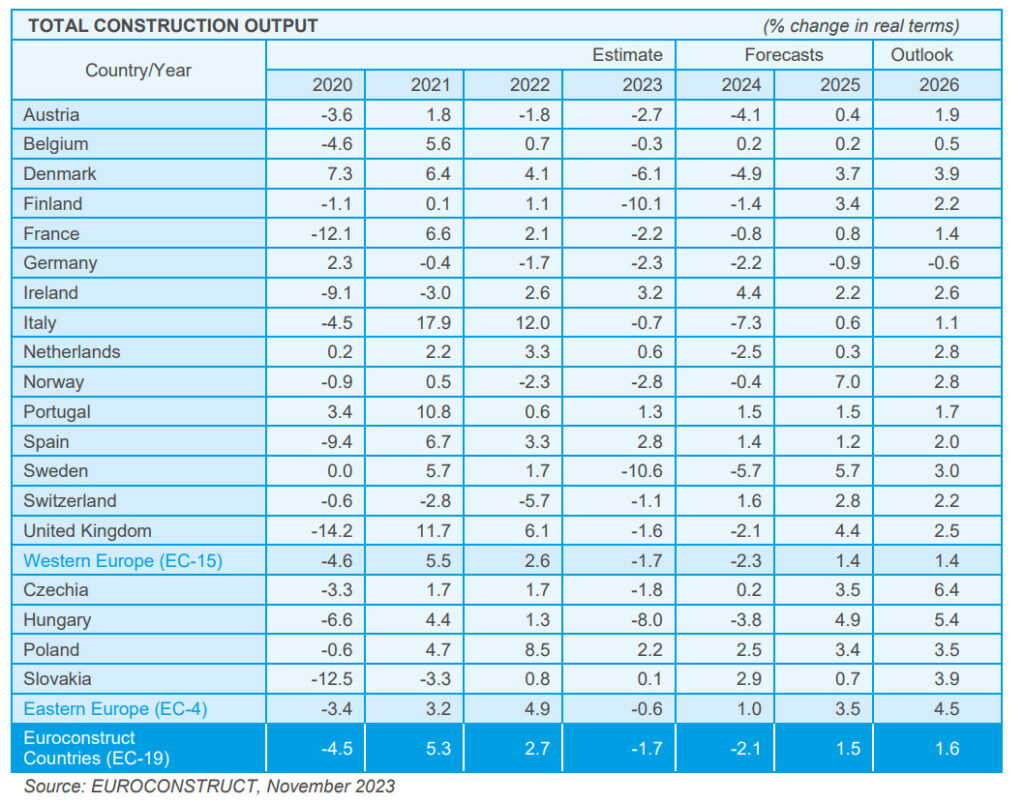

Following an unexpected but welcome period of growth in 2022, the construction industry within the 19-EUROCONSTRUCT countries is facing a gloomier outlook in 2023 and beyond. Assessments of the consequences of the interest rate hikes and the war in Ukraine have increasingly dampened avenues of growth within the industry. While the EUROCONSTRUCT network was still forecasting stagnation of total construction output in 2023 and 2024 around a year ago, the expected rates of change slipped into negative territory in the summer of 2023. The country experts are now forecasting a decline of 1.7% for 2023, with the decline worsening in 2024. The network is forecasting moderate growth of around 1.5% each year in 2025 and 2026.

While civil engineering will continue to expand unabated in the years 2023 to 2026, building construction will shrink. Non-residential building construction is forecast to stagnate until 2024 and then is expected to resume growth once again. Residential construction, on the other hand, will lose some of its market volume in these two years and will only grow at a modest pace in later years.

At the country level, there are distinctive features that also have an impact on regional market developments. However, most of the 19 national markets are experiencing a slowdown – some more than others – from the sharp rise in interest rates and construction prices, persistently high inflation, the loss of purchasing power among private households, weaker economic growth, the tighter public budget situation, and falling property prices. At current interest rate levels, a yield comparison for property investments is also hampering growth. Added to this is the growing uncertainty for the future of hybrid work practices and the impact on commercial real estate.

According to the results of the ECB’s bank lending survey, lending standards tightened in all loan categories in the third quarter of 2023. Demand for credit from companies and households continued to fall significantly. By 2025, the number of housing completions is expected to fall to the lowest level since 2016. For September, the European Central Bank reported an average interest rate of just under 3.6% for mortgages with a 10-year commitment period to private households in the Eurozone, compared with just under 1.4% at the beginning of 2022.

Furthermore, consumer price inflation is also expected to remain above historic norms in many countries in 2024. A small minority of country partners expects inflation to fall below the 2.5%-mark next year, and the second-round effects of ongoing wage adjustments are likely in the near term.

Contrary to expectations from the summer of 2023, new construction of non-residential buildings is now also expected to shrink by 2024. Prospects for 2024 are now viewed more cautiously in eleven countries, with widespread downward revisions taking place across the board.

The building renovation sector, which grew strongly in 2022, is now expected to experience a contraction, attributable to the downturn in the residential sector. Overall, renovation on existing buildings in the EUROCONSTRUCT area is likely to shrink in 2023 and in 2024, driven by the residential sector. Viewed separately from residential buildings, renovation work in non-residential building construction is forecast to grow in both 2023 and 2024. Indeed, from 2024 onwards, new construction work is expected to be surpassed by the renovation sector.

Civil engineering is unlikely to experience a decline until 2025 and will prove more resilient than the buildings sector. 2023 is likely to have been significantly better than expected in the summer forecast. Upward revisions in forecasts are observed especially in the energy sector and, to a lesser extent, in road construction. Growth in this sector is due to the pressing need for action in relation to transport networks and energy production and distribution, given the current socioeconomic and political climate. The long-term outlook for the civil engineering sector remains positive, as these are projects that will take years to complete.

Source: EUROCONSTRUCT

Copyright 2017-2023 All rights reserved.

Copyright 2017-2023 All rights reserved.