This report contains an in-depth analysis of the macroeconomic situation in Europe, insights into these sectors, such as construction, mining and rental and a substantial focus on the sales performances of machinery & equipment.

2022: the great awakening of inflation

From an economic perspective, a sustained resurgence in the level of prices was the most striking feature in 2022. It led to a shift in monetary policies towards a more restrictive approach, involving increases in interest rates and a gradual exit from unconventional policies with the start of the reduction in the size of central banks’ balance sheets.

The surge in inflation was the result of the significant imbalances that the world economy had to deal with during the pandemic. This was a result of the significant budgetary and monetary stimuli deployed by many countries during 2021, which led to great pressure on production capacities and resulted in many shortages. The start of the conflict in Ukraine

created further shocks to the economy resulting in increases across a wide range of commodity prices, but which turned out to be temporary.

The damaging effects of higher inflation have been experienced in 2022 with the loss of purchasing power for organisations whose income is not indexed to inflation. In addition, the restriction on mobility in China during the pandemic for most of 2022, impacted on activity levels.

All in all, the post-Covid rebound phase is over. It gave way to growth that weakened throughout the year. As a result, 2022 marked the end of an exceptional period – one involving negative rates. While inflation keeps reducing households’ disposable incomes, the decline in economic activity is set to continue in the first quarter of 2023.

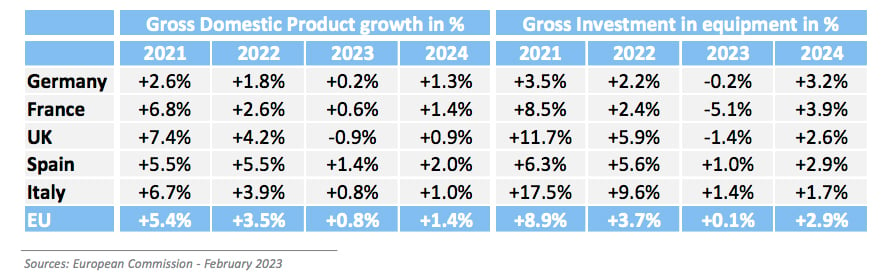

In Europe, growth is expected to return in the spring as inflation gradually relaxes its grip on the economy. However, with powerful headwinds still holding back demand, economic

activity is set to be subdued, with GDP growth expected to reach 0.3% in 2023 in both the EU and the euro area.

Construction activity in Europe is set to stagnate this year and next

The era of low interest rates within Europe has ended, and higher interest rates and a weaker economy are making home buyers and businesses more reluctant to invest in new residential and nonresidential buildings. In addition, rising costs for building materials have made new investments more expensive, although prices for some building materials have fallen in recent months.

Residential sales have slowed down, consumer confidence has plummeted and there is now

oversupply of housing in many countries. As a result, the outlook for growth in new residential construction has deteriorated. The outlook is not much brighter when considering the situation in other sectors within the construction industry. However, civil engineering is emerging as the most positive sector, with many countries investing in low carbon energy and renovation of the existing infrastructure.

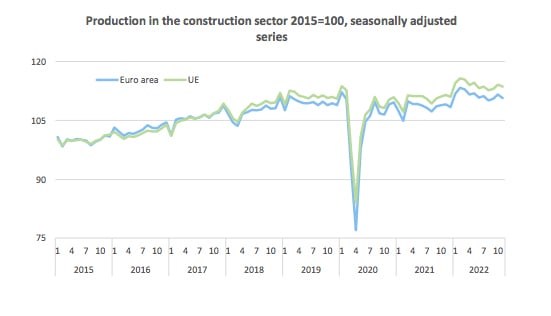

AT LEAST 3% GROWTH IN CONSTRUCTION OUTPUT IN 2022

Not all data is available yet for construction activity in 2022 in Europe, but the estimates published so far are positive. According to Eurofer, construction output in the third quarter last year in the EU increased by 2%, following an increase of 6.5% in the second quarter, both year on year. This was despite the continued rise in costs and increasing levels of economic uncertainty.

According to Eurostat, in the euro area in November 2022, compared with November 2021, civil engineering output increased by 1.7% and building construction by 1.2%. In the EU, civil engineering output increased by 2.8% and building construction by 1.6%. Among Member States for which data is available, the highest annual increases in construction output in 2022 were seen in Slovenia (+44.0%), Romania (+20.4%) and Belgium (+12.9%). In contrast, the largest decreases were recorded in Spain (-6.9%), Slovakia (-5.8%) and Germany (-1.2%).

According to the European Commission’s latest report, construction output in the EU in October and November grew by an average of 0.7% compared with the previous quarter, following declines in both the second and third quarters.

CONSTRUCTION ORDER BOOKS ARE STILL WELLFILLED

The order books for EU construction firms are still well filled with 9 months of work identified at the beginning of 2023. The confidence indicator for EU construction declined in the first half of 2022, but since then has hovered around a neutral position. This suggests that developments are positive in some subsectors. High energy prices are creating additional demand for energy-saving construction work in both the new build and repair and maintenance markets.

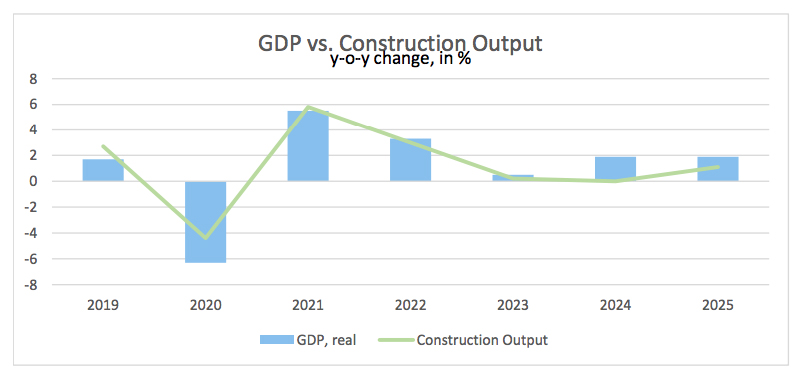

A DIFFICULT PERIOD OF ADJUSTMENT FOR THE INDUSTRY, BEFORE A RETURN TO GROWTH IN 2024

According to Euroconstruct, two difficult years can be expected for the construction sector across Europe, with growth forecast at just 0.2% in 2023 and 0% in 2024. A return to growth in output looks unlikely before 2025.

DIFFERENT PAST AND FUTURE PERFORMANCES IN THE MAJOR MARKETS

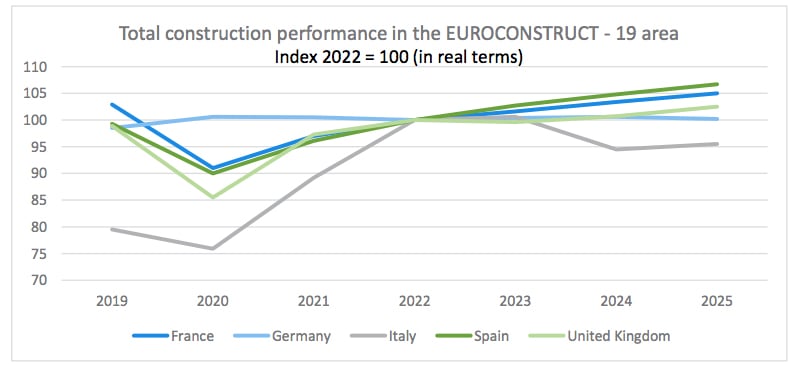

Italy was the strongest market in Europe in 2021, with a growth in output at 12.1%, driven in part by EU subsidies. Following this, 2022 was an exceptional year for the construction sector in Italy with activity levels reaching close to the peak levels achieved in 2007. The construction market has benefitted from significant private resources, such as the savings accumulated by households and businesses in both 2020 and 2021.

In a recent interview delivered to Ritchie Bros, Riccardo Viaggi, Secretary General of the Committee for European Construction Equipment (CECE) has revealed optimism about the future months.

“2022 was a tough year, but better than we initially expected, leaving the industry in fairly good shape by the year’s end” said Riccardo “Our November business barometer, which surveys around 100 industry leaders, highlighted an uptick in business sentiment after six continual months of declining expectations – although this never entered negative territory. I’m not sure we can attribute it entirely to ‘the bauma effect’ but roughly 90% of them said their overall business perspective was ‘good’ or ‘very good’ so we certainly don’t expect a ‘bloodbath’.”

He also added that higher interest rates may delay some residential and commercial projects, but that may be balanced out by the infrastructure and civil engineering sectors that should remain strong. There are counter-cyclical initiatives in place to counter any recession in the EU, with post-COVID recovery plans and Climate Change mitigation measures, also including machinery trends such us eectromobility.

“We want to have a positive impact on the environment, society and economies, all of which can be achieved by using machines with a lower carbon footprint. It’s not just a powertrain issue though – the other efficiency improvements make battery electric models easier to operate, so they offer Health and Safety advantages. There’s noise advantages too, meaning fewer disruptions for the wider population when operating in cities.”

affirms Riccardo Viaggi.

However, in 2023, a turnaround is expected. 2023 will be a transitional year, marked by a general slowdown, but overall growth in output is expected to remain positive at 0.9%.

From 2024, the market is forecast to slow down significantly. Total investment is forecast to decline by 7.1%, and residential repair and maintenance is expected to decline by 22.6%.

The UK is currently one of the worstperforming economies in Europe. This fall in activity is primarily due to rising mortgage rates, falling real wages and poor consumer confidence. In addition, government policy is less supportive for house building, with the ending of the Help to Buy scheme, the Residential Property Developer Tax and the Building Safety Levy.

In contrast, infrastructure continues to go from strength to strength, reaching historically high levels in 2022 as it benefitted from multi-billion pound projects such as HS2, the Thames Tideway Tunnel and Hinkley Point C, as well as long-term frameworks activity in subsectors such as rail, roads and energy. Looking ahead, further growth in infrastructure is expected but it is likely to be slower than in previous years due to inflation and financial constraints.

The outlook for the construction market in Germany is gloomy. The impact of higher construction costs, labour market constraints, and a challenging financial environment for the industry will continue to weigh heavily on the market in 2023. The impact will be most pronounced in the residential building sector. However, a substantial pipeline of infrastructure projects will offset the wider cyclical decline in construction activity.

Finally, the credit rating agency Fitch are forecasting that Germany’s construction industry will grow by a moderate 1.2% in 2023, after a surprising downturn in construction output of 2.3% in 2022. The construction market in Spain is expected to outperform the Eurozone average in 2023. Euroconstruct expect the construction sector to grow by almost 3% in 2023, after showing growth in output above 12% in 2022. In 2024 and 2025 growth in the sector is expected to ease back to 2% for both years.

The outlook for construction activity in 2023 is subdued due to low economic growth of 0.1% and elevated inflation and high interest rates. Higher prices for construction materials and higher wage levels, together with tighter environmental standards, impact significantly on building costs. In addition, supply chain issues for some materials are still causing delays on construction work.

To read the full report: CECE

Copyright 2017-2023 All rights reserved.

Copyright 2017-2023 All rights reserved.