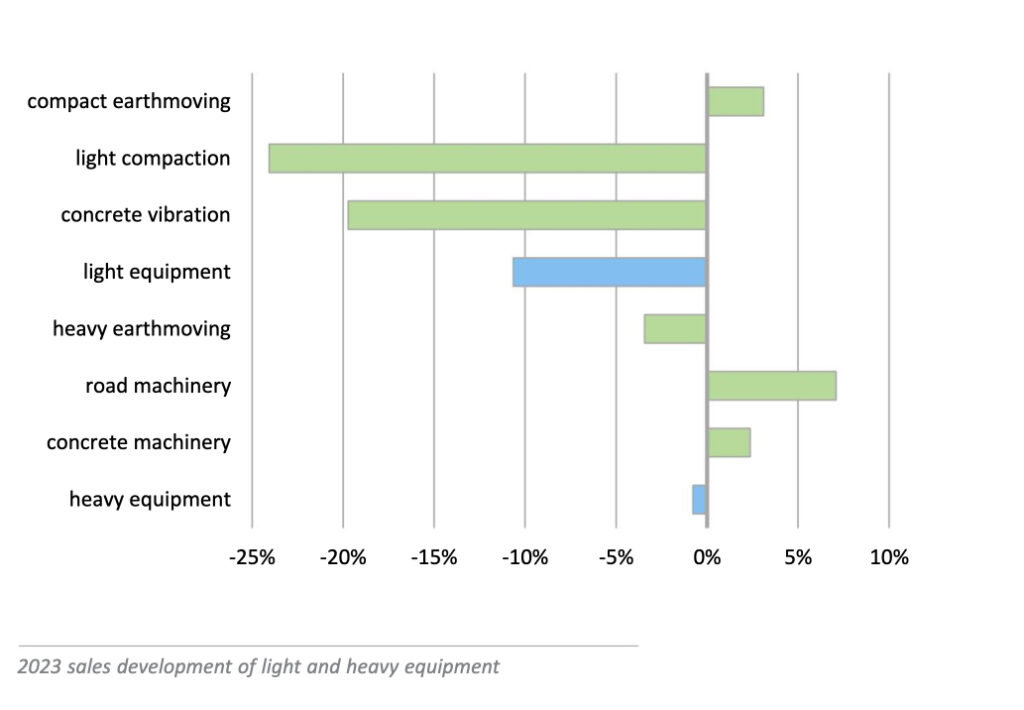

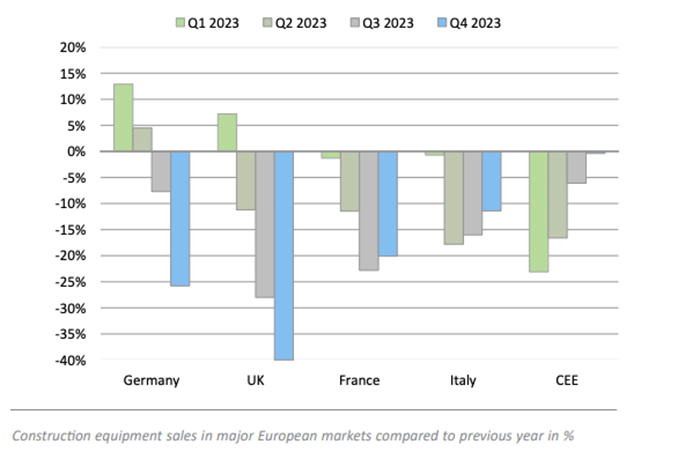

According to CECE’s annual economic report, sales of construction equipment in Europe declined by 10% in 2023, following a period of very high absolute levels. The decline was primarily attributed to a downturn in road machinery, particularly light compaction equipment, which saw sales fall by 21%. Earthmoving equipment and concrete equipment maintained stable performances, with minimal 1% growth in sales.

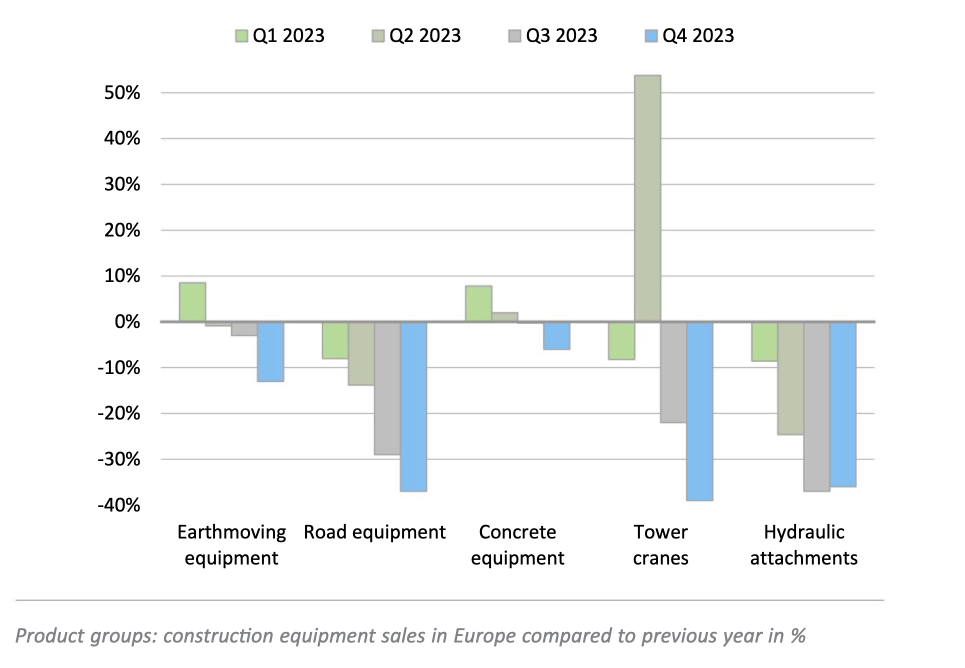

With growth in sales of 16% in Europe in 2023, tower cranes were the strongest performing of the construction equipment sub-sectors. However, this is solely attributable to the one-off effect in Turkey, where reconstruction efforts after the earthquake pushed tower crane sales significantly. If Turkey is excluded, sales of tower cranes in Europe were down by 27% in 2023.

Outside of Europe, growth in key export markets like North America and the Middle East helped European manufacturers improve their overall business performances despite the challenging market conditions in 2023.

“In the face of global economic challenges, I remain cautiously optimistic about the possibility of a smooth landing for the economy in 2024-2025. While the Eurozone has experienced setbacks, including the impact of the war in Ukraine and inflationary pressures, I believe that prudent decision-making and concerted efforts can mitigate risks. By focusing on stimulating investment and fostering innovation, Europe can navigate through these challenges and pave the way for sustainable growth and prosperity.”

said CECE President Jose Antonio Nieto at the Market Update event launching the 2024 CECE Annual Economic Report.

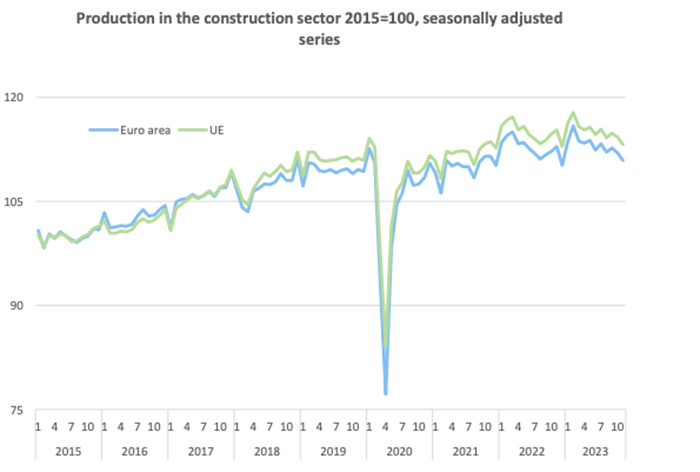

According to Euroconstruct, construction output is expected to be lower than expected in 2024, and a recovery is not anticipated until 2025. The European construction industry is forecast to show a 2.1% decline in 2024 followed by moderate growth of around 1.5% in both 2025 and 2026.

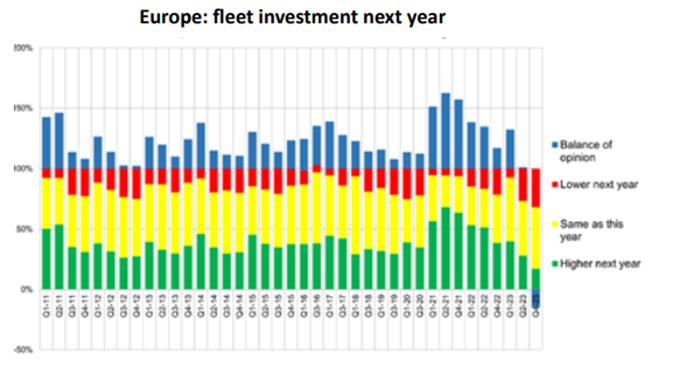

According to the CECE report, the noticeable deterioration in business sentiment in Europe’s equipment rental industry from the middle of 2023 continued through to the end of the year, although it is a far from dramatic decline. In the Q4 ERA/IRN RentalTracker survey, undertaken at the end of December and start of January, almost a third of companies reported a deteriorating situation, with more than 40% seeing no change and 27% reporting improving conditions. That led to a negative balance of opinion of -5% (the difference between the proportions reporting positive and negative views), which is almost identical to the results of the Q2 survey at the end of June 2023.

Sales of Earthmoving equipment went up by a minimal 3% in 2023. This began with a strong first quarter (+9%) with many machines being delivered to help clear the supply chain bottlenecks from the year before. Following this, momentum slowed in Q2 and Q3, with single-digit declines in sales. Finally, the last quarter ended up at 13% below Q4 levels in 2022. This slowing momentum alongside low new order intake points towards a difficult first quarter for 2024.

The European construction equipment sector experienced a year of transition in 2023, marked by significant challenges amidst a severe downturn in the building construction industry and increased geopolitical crises. Despite facing headwinds, the industry demonstrated resilience with relatively stable sales on the European market, albeit with notable differences across sub-segments and regions.

Outlook 2024

Looking ahead, the outlook for 2024 remains uncertain, with cautious optimism tempered by ongoing challenges. The European market is expected to face further declines, particularly in the building construction equipment segments, amidst economic uncertainty and geopolitical threats. However, opportunities in global export markets may provide some respite for European equipment manufacturers, with North America remaining a key focus.

Source: CECE

Copyright 2017-2023 All rights reserved.

Copyright 2017-2023 All rights reserved.